⭐ With Spike Financial as your merchant services provider, you’ll get custom payment solutions, 24/7 Texas-based tech support, and excellent prices.

⭐ Our current customers enjoy lower rates than they were getting when they let their big bank run their POS systems. We offer a free statement analysis so you can discover exactly how Spike Financial can help you cut your POS system costs.

⭐ With our surcharge program, our customers pass along credit card fees to their customers, which helps reduce POS operating costs.

Take Your Business Further With Payment Solutions From Spike Financial

# Dallas, Texas Cell Phone Repair Kiosk Needed Tech Support

With a merchant services company that was unresponsive to their requests for technical support, a Dallas cell phone repair kiosk owner turned to Spike Financial for help.

🤔 After waiting on hold for hours over multiple days to get in touch with tech support, this kiosk owner decided to find out if Spike Financial could help. He asked us for a sleek and space-saving terminal paired with a surcharging program that would save him money.

👍 Spike Financial’s Solution:

😀 We provided the merchant with a Dejavoo Z9 wireless terminal that works with his existing WiFi connection. He can put the terminal away easily when it’s not in use. After enrolling him in the surcharging program that passes fees along to customers, he now enjoys zero credit card fees. In the future, when the kiosk owner requires tech support, he’ll have access to our live Texas-based tech experts 24/7 for on-demand in-person and mobile support.

# Fort Worth, Texas Liquor Store Owner Needed Multi-Functional POS Terminals with Multiple Locations for a High Volume of Transactions

New Covid-19 precautions mean this store owner also needs to offer seamless payment options for curbside pickup.

🤔 With busy times occurring on weekends and holidays, this Fort Worth liquor store owner needed robust POS equipment set up to handle numerous transactions at three separate pay stations within his store. He needs to take payments in person, online, through his mobile app, and for curbside pickup order fulfilment.

👍 Spike Financial’s Solution:

😀 We brought in state-of-the-art equipment with customer-facing displays, receipt printers, and countertop barcode scanners connected to EMV-enabled Pax S300 pin pads. His Spike Financial merchant account has low processing fees and integrates seamlessly to our payment processing service using a payment gateway connected to his mobile app and online ordering system.

His store’s employees can now quickly take payments from customers at curbside pickup when necessary. The liquor store owner is so pleased with his new POS system that he referred several other business owners to Spike Financial.

# Houston, Texas Full-Service Italian Restaurant Owner Struggles With High Processing Costs and Slow POS Terminals

10-year-old POS terminals and lack of EMV compliance made taking payments frustrating and risky.

🤔 This Houston restaurant owner thought using a popular and widely-known POS software system would protect him from chargebacks and keep his business running smoothly. His equipment was outdated and slow, resulting in frustrated employees and customers. Without EMV chip compliance, this restaurant owner faced a growing liability for chargebacks. He was unaware of exactly how expensive his current system was, but was reluctant to switch to Spike Financial because he had been with his current merchant services provider for so long.

👍 Spike Financial’s Solution:

😀 After looking through his free savings analysis, the restaurant owner realized he would save more than $400 each month in processing costs by switching to Spike Financial. We replaced his two buggy POS Systems with new state-of-the-art touch screen monitors and integrated them with two EMV-compatible pin pads that worked with his current setup. This allowed him to get the functionality that he needs without having to make a huge investment in expensive POS equipment. He now has a fully-EMV compliant system that prevents credit card issuers from shifting chargeback liability to the restaurant. Plus, he’s saving more than $4,800 each year in processing costs, alone.

Spike Financial serves customers across the country and throughout Texas in cities such as Houston, Dallas, Waco, Temple, Killeen, Tyler, Austin, San Antonio and many more.

Learn how Spike Financial can connect you to the technology your business needs at an affordable price.

Spike Financial Customers Get:

- Food Trucks

- Handyman

- In-Home Repair Services

- Moving Companies

- Farmers Market Vendors</li

- Business-to-Business Transactions

- Landscapers

With Spike Financial, you'll be able to take Every Payment—Every Time

- EBT

- PIN Debit

- EMV Chip

- Apple Pay

- Samsung Pay

- Credit/Debit Tap

- HSA Debit Cards

- FSA Debit Cards

Mobile and in-person POS terminals allow your customers to pay any way they please:

- Over the phone

- In-person at your store

- In-person on the go

- At the gas pump

- At your food truck

- With contactless pickup

- Integrated with your online shopping cart

Our Systems Are Designed To Meet Your Needs

Low-Priced one-time equipment fees mean you’ll never get stuck in an expensive lease

Custom-built Point-of-Sale (POS) systems for your business

Spike Financial customers get excellent ongoing support, fair pricing, and great products.

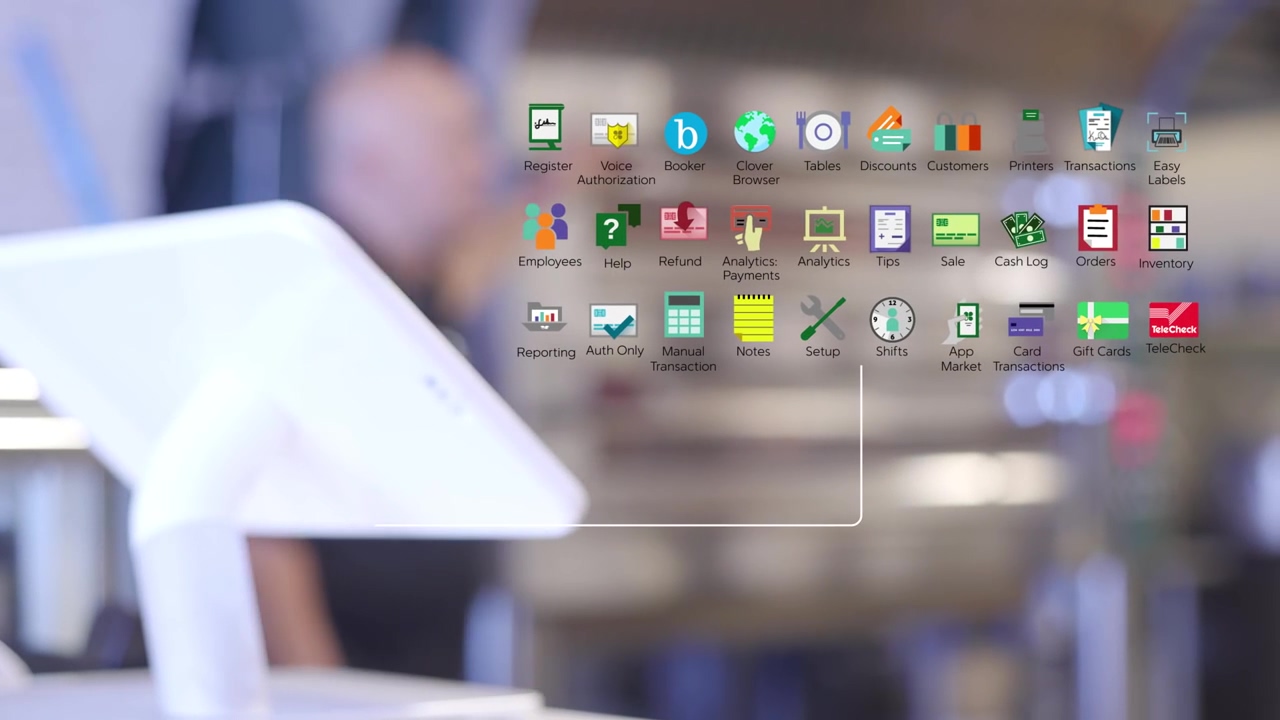

The Clover® Station

A state of the art, all-in-one Point-of-Sale solution for your business. Power it up and you’re ready for business. Clover Station is designed to help in so many ways.

The Clover® Mini

A counter-top terminal from First Data® that offers users speed as well as a seamless user experience. The Clover® Mini is as powerful as it is sleek—and lightweight.

Clover® Flex

Take on-the-go payments using this small, but powerful portable device from First Data®. It’s everything you need in one simple device.

Clover® Go

Go here. Go there. Process payments anywhere. A mobile payments reader designed to work with cell phones. It makes payments easier – and safer.

Get your free statement analysis today.

Please complete the short form below and upload your current merchant statement to receive a free, no obligation, statement analysis.

Latest News

Payments in Focus | Insight that keeps you ahead of change | Never Miss a Blog

Top 5 Credit Card Machines/POS Terminals for Convenience Stores

Convenience stores require a merchant processing solution that’s quick, easy to use, multi-functional, and d...

Could Interchange Plus Pricing Reduce Your Merchant Services Fees?

Businesses must offer customers the option to pay with a credit or debit card or risk losing customers. Taking...

What Steps can Businesses take to Ensure Healthier Cash Flows?

One of the most important aspects of running a business is ensuring that the business has healthy cash flows....

Small Businesses Need Dedicated Merchant Services; Big Banks Aren’t the Answer

Small business owners have a long to-do list, and while choosing a merchant services provider is essential, th...